startup company equity structure|Managing Startup Equity : Bacolod How to structure equity in a startup. Equity structure is one of the most crucial aspects of any startup. It refers to how ownership and equity are distributed . If you are a fan of NBA , you don't want to miss the chance to bet on the latest NBA odds with FanDuel Sportsbook. You can find the best lines, spreads and moneylines for every game, every night. Whether you want to bet on the NBA Finals, the MVP race, or the regular season action, FanDuel has you covered with live betting, easy deposits and .👑 DraftKings Sportsbook gives you more ways to have skin in the game and get closer to the games you love, all on a safe and secure platform. 👑 Join DraftKings's online sportsbook for FREE and win cash .

PH0 · Understanding equity for your startup

PH1 · Startup Equity 101

PH2 · Startup Equity

PH3 · Startup Employee Equity: What Every Founder Should Know

PH4 · Managing Startup Equity

PH5 · How to Distribute Equity for Your Startup

PH6 · How Startup Equity Works: A Comprehensive Guide

PH7 · How Startup Equity Works

PH8 · Equity Distribution in Startups: What New Founders Need to Know

PH9 · A Founder’s Ultimate Guide to Startup Equity

The Kunsthaus in Austria’s second city, Graz, attracts visitors not just with its modern art exhibitions, but with its unusual architecture: Opened in 2003, it is said to look like a “friendly alien” in the midst of Baroque architecture. With its large, tube-like "nozzles" for windows that stick out from the curved roof and its .

startup company equity structure*******We explain the basics on startup equity distribution and shared how to determine the right equity compensation for co-founders, advisors, investors, and early-stage employees.

Startup founders have a handful of directions they can take to divide their .startup company equity structure Managing Startup Equity Startup founders have a handful of directions they can take to divide their startup's equity. We'll explain the most popular approaches toward dividing ownership . You’ve taken on plenty of challenges as you've grown your business — distributing startup equity is just another one to figure out. So to help you with the process, we'll review what startup equity is, . How to structure equity in a startup. Equity structure is one of the most crucial aspects of any startup. It refers to how ownership and equity are distributed .Introduction. At the heart of every thriving startup is a well-considered approach to equity distribution. This critical component defines the financial future of a company and its .

How to distribute equity in your startup. It’s important to set aside a number of shares of your organization, known as an equity pool, as early as possible. Many startups set . Creating a Cap Table. Purchasing Founder Shares. Allocating Equity. The first task in distributing equity in a startup is allocating your startup equity. There are a .Essentially, startup equity describes ownership of a company, typically expressed as a percentage of shares of stock. On day one, founders own 100%. If you have more than . Phase One - Startup Equity - Avoiding Early Mistakes. Phase Two - How Startup Equity Works. Phase Three - How to Split Equity. Phase Four - Part 1 - Equity Management ( ←YOU ARE . Capital Structure: The capital structure is how a firm finances its overall operations and growth by using different sources of funds. Debt comes in the form of bond issues or long-term notes .

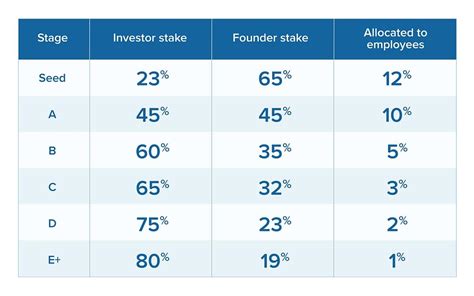

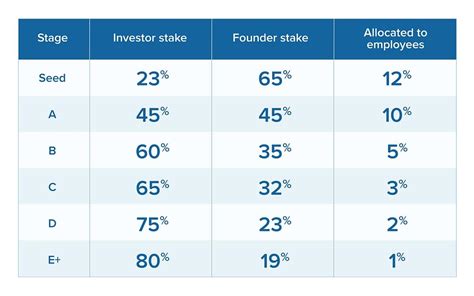

There’s no single best choice in terms of the type of company entity you choose, but there is a best choice for your company equity based on your goals. If you’re setting your business up as an equity play the structure that will facilitate stakeholders’ participation in stock sales while giving you the most flexibility and predictability .Managing Startup Equity Initial equity. The founders of a startup generally purchase shares at the time of incorporating the company at a nominal price per share, such as $0.0001 per share, paid in cash, since at that time the company will have no operating history, few assets and thus little value. These shares are referred to as founders’ shares.Investors then put money into your business in return for an equity stake. Again, the amount of equity each investor receives should represent how much they have put in. So, for example, if you seek $1 million and offer 20% of your company's equity in return, an investment of $500,000 would buy a 10% stake. Well-known investors may attempt to .Definition of Equity Structures. An equity structure is an agreement between the shareholders of a company, setting down the investors’ rights and obligations in respect of the company’s profits and assets. Equity structures outline the way in which a company’s profits are divided amongst the shareholders and how the assets are utilised.How to distribute equity in your startup. It’s important to set aside a number of shares of your organization, known as an equity pool, as early as possible. Many startups set aside between 10-20% of their shares in order to have the means to incentivize employees. This amount is on top of the shares they are already awarding to co-founders .

There are essentially 4 components to setting up the fundamental structure of our Stock Plan: Stock Structure. We need to figure out exactly how our stock will be setup to distribute. There are several ways we can address this depending on how we want to manage control of the company. Vesting Schedule.Equity can be a huge incentive for joining a startup early, but knowing when to exercise your options, how to get paid out, how much you’ll make, and how much you’ll get taxed is not at all obvious. It’s important to have a solid understanding of how options work, because the way you use them can have huge financial consequences.

They agree that the amount of capital that each invests in the venture will account for 50% of the equity split and they will divide the other 50% equally. Co-founder A contributes ¾ of the funds and co-founder contributes ¼. Following the transactional approach, the team agrees that co-founder A should receive 25%, plus ¾ of the remaining .Splitting Equity. We’re going to identify and isolate each of the key issues in splitting up equity in a startup company. Then one by one we will lay out which options are available, how most startups address this problem, and what key decisions the team will need to make to split the equity fairly and manage a plan long term. Start Playbook.

You may see equity called “shareholders’ equity” (public companies) or “owners’ equity” (private companies). In each case the definition is the same: Equity is the portion of ownership shareholders have in a company. Types of equity in the private markets vary according to the legal business structure of the entity offering it. Some .Founders tend to make the mistake of splitting equity based on early work. All of these lines of reasoning screw up in four fundamental ways: It takes 7 to 10 years to build a company of great value. Small variations in year one do not justify massively different founder equity splits in year 2-10. More equity = more motivation.

Who gets equity in a startup. When your startup is in the initial stages, the founder or the co-founders usually own it entirely, typically in a 50/50 split, or 60/40, depending on various conditions. As you grow, equity .

startup company equity structureWho gets equity in a startup. When your startup is in the initial stages, the founder or the co-founders usually own it entirely, typically in a 50/50 split, or 60/40, depending on various conditions. As you grow, equity .A cap table, or capitalization table, is a spreadsheet that shows the ownership stakes in a company. It is important for startups to maintain an accurate cap table as they grow and raise capital from different sources because it helps track stock ownership, convertible securities, warrants and options, stock compensation grants to provide a fully-diluted .

Capital structure describes the mix of a firm's long-term capital, which is a combination of debt and equity. Capital structure is a type of funding that supports a company's growth and related .

1. Choose a template. There are templates all over the internet, including at the bottom of this article. Choose one that best fits your startup or create your own with pieces from different templates. The goal is to create a founders agreement that best fits your, your cofounders', and your startup's needs.Equity represents ownership in a startup. It is distributed among founders, employees, investors, and advisors. Each plays a pivotal role in the company's growth and success. Determining the share of equity requires a balance. This balance is guided by contribution levels, commitment, and the company's valuation at the time of distribution.

The first investors in your startup are likely to be friends and family or angel investors. In the pre-seed and seed funding rounds, startups raise anywhere from $50,000 to $200,000 for a 5% to 10% equity stake. As your business grows, you may also decide to raise additional capital.

FAQs How do I check my lotto ticket? Australian Saturday Lotto TattsLotto results are drawn live on Channel 7, 7TWO (and affiliated regional stations) or online on the 7plus website at 8:30pm AEST and 9:30pm AEDT every Saturday. If you miss the broadcast, the results are posted online or on the Oz Lotteries app half an hour after the broadcast.

startup company equity structure|Managing Startup Equity